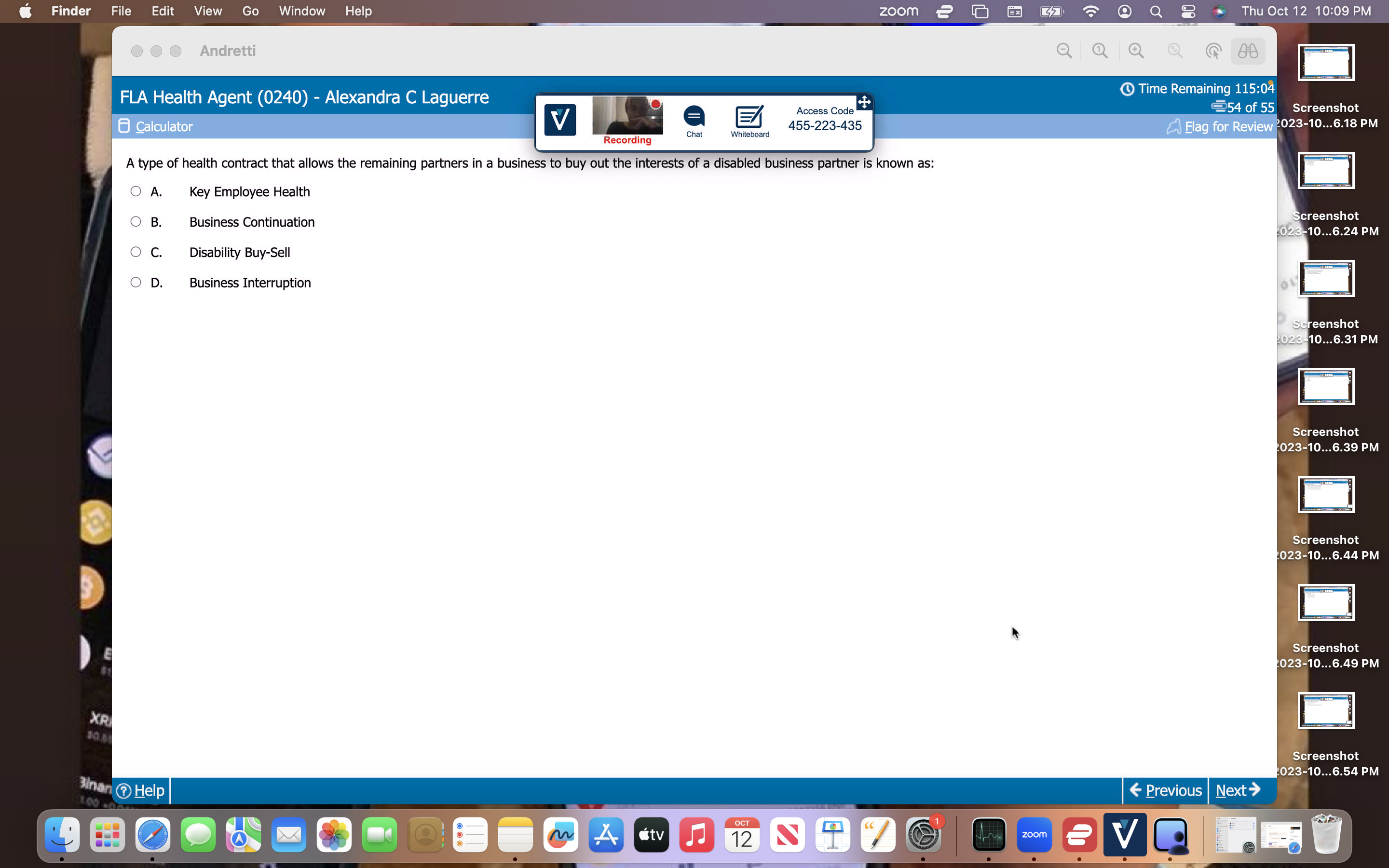

If the owner dies or becomes disabled, the policy would provide which of the. A policy owner would like to change the. With life insurance, the needs. Split dollar plan b. Benefits are taxable to the business entity b. Here’s the best way to solve it. Powered by chegg ai. View the full answer. A) the length of time a disability must last before the remaining partners can buy out the. Which of the following disability buy sell agreement is best suited for businesses with a limited number of partners. To ensure an orderly transfer of your business when you die; To set a value on the business for transfer and.

Related Posts

Recent Post

- Nicole Simpson Murder Scene

- Spectrum Make An Appointment

- Busted Newspaper Grant County Wisconsin

- Learn To Fly 1forum Create Topic Html

- Esthetician Jobs Indianapolis

- Barrie Death Notices

- Wgem News Quincyabout Html

- Walmart Team Lead Bonus

- Zillow Trailer Homes

- Student Wgu Portal

- Obituaries In Clinton Ncindex Htmlbirthday Today Horoscope Sign

- Ups Store Cardboard Boxes

- Part Time Immediate Hire Jobs

- Allen Sons Trash Service

- Baldwin County Dmv Appointment

Trending Keywords

- Nuera East Peoria Medical Menu

- Increase Limit On Wells Fargo Credit Card

- Great Falls Tribune Obituaries

- Calottery 2nd Chance Winners

- Nicole Simpson Murder Scene

- Spectrum Make An Appointment

- Busted Newspaper Grant County Wisconsin

- Learn To Fly 1forum Create Topic Html

- Esthetician Jobs Indianapolis

- Barrie Death Notices

Recent Search

- Gentry Funeral Service Jonesville Nc

- Gentry Funeral Home Jonesville

- Monkeys For Sale In Usacontribution Html

- Venice Herald Tribune Obituariespodcast Personal Html

- Composite Boards Menards

- Virtua Urgent Care Voorhees

- Ixl Free Math

- Pugh Funeral Home Asheboro

- Autotrader Canton Ohio

- Knoxville 24 Hour Arrest

- Remote Lpn Jobs Virginia

- Wreck In Tennessee On I 40index2 Html

- Nuera East Peoria Medical Menu

- Increase Limit On Wells Fargo Credit Card

- Great Falls Tribune Obituaries

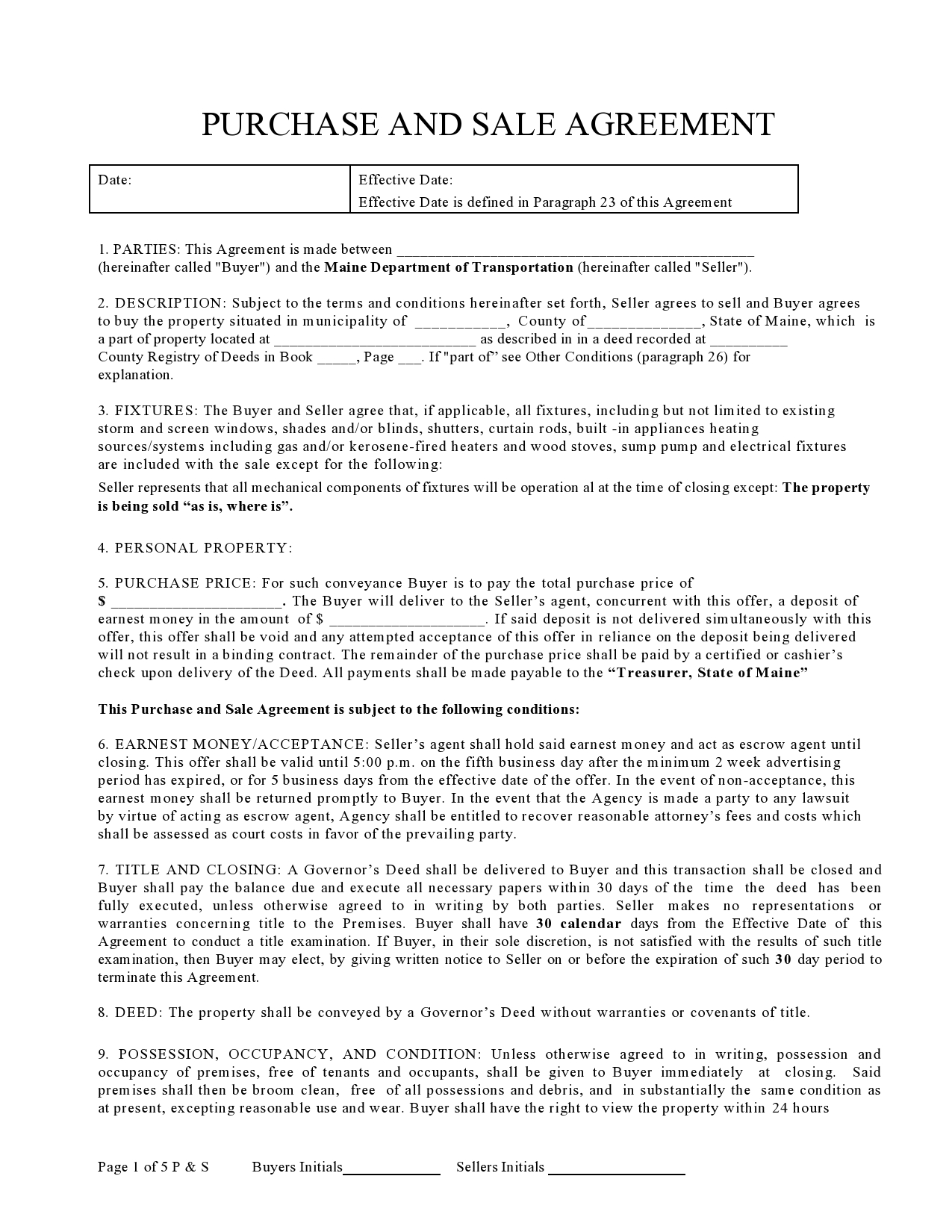

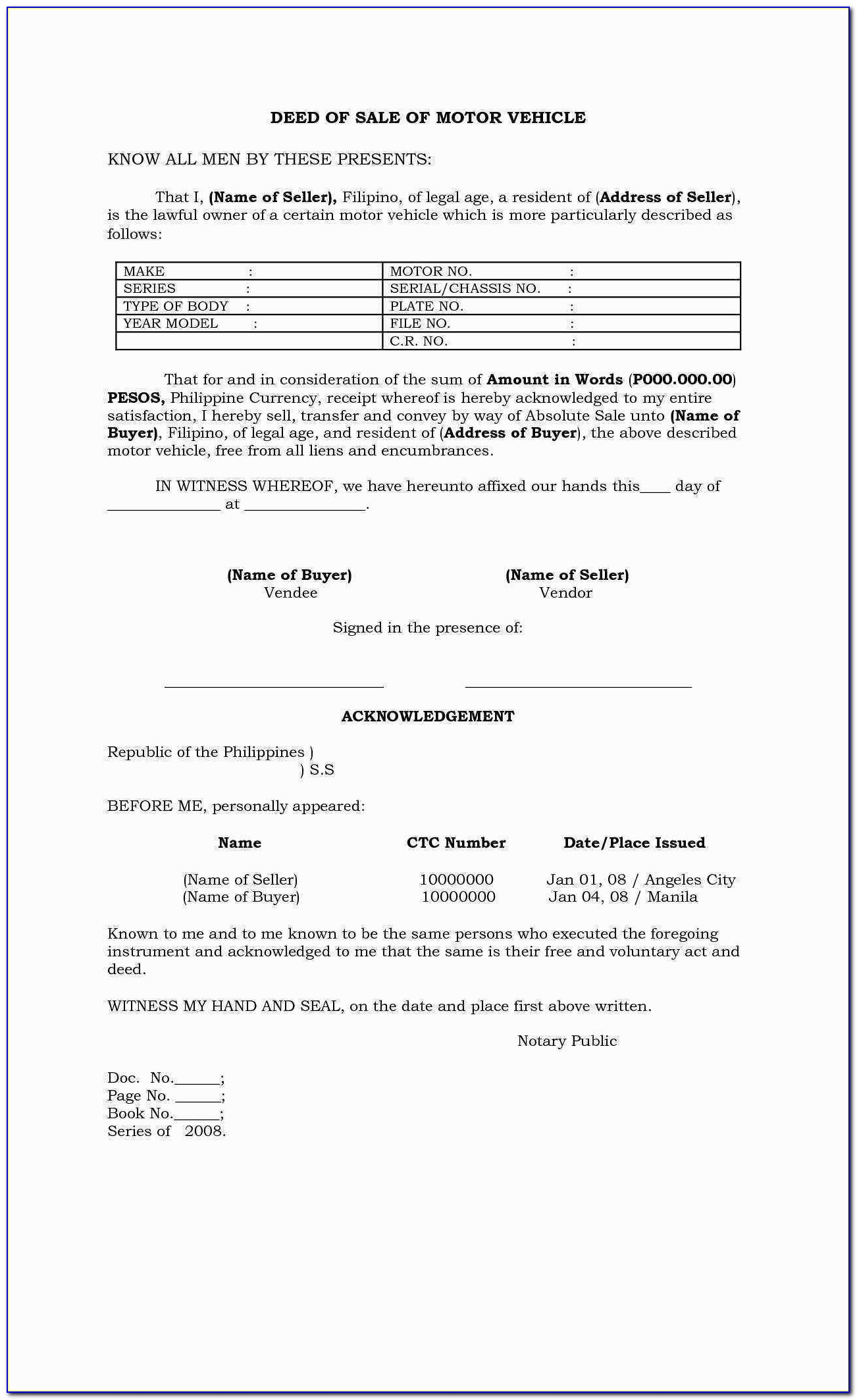

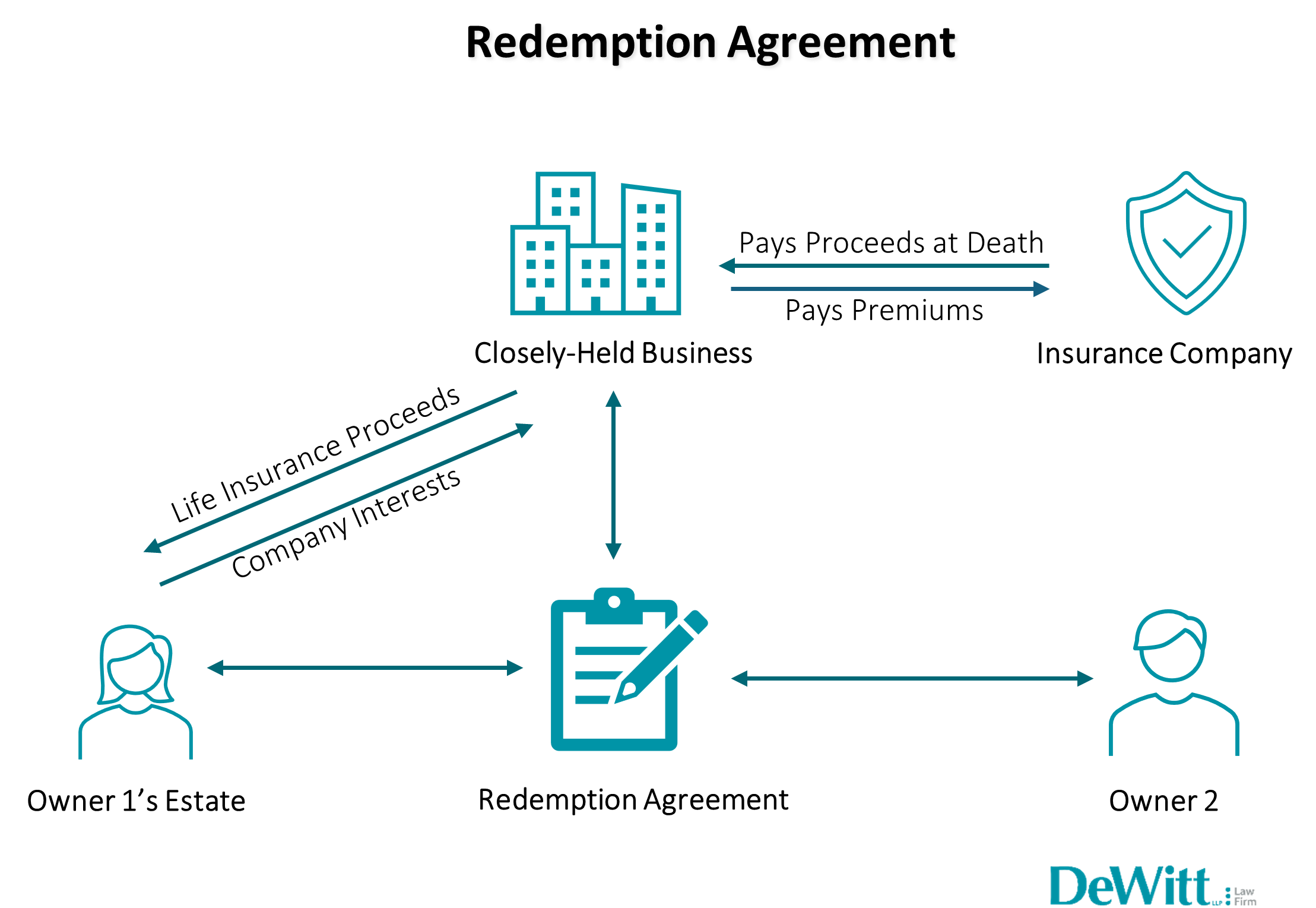

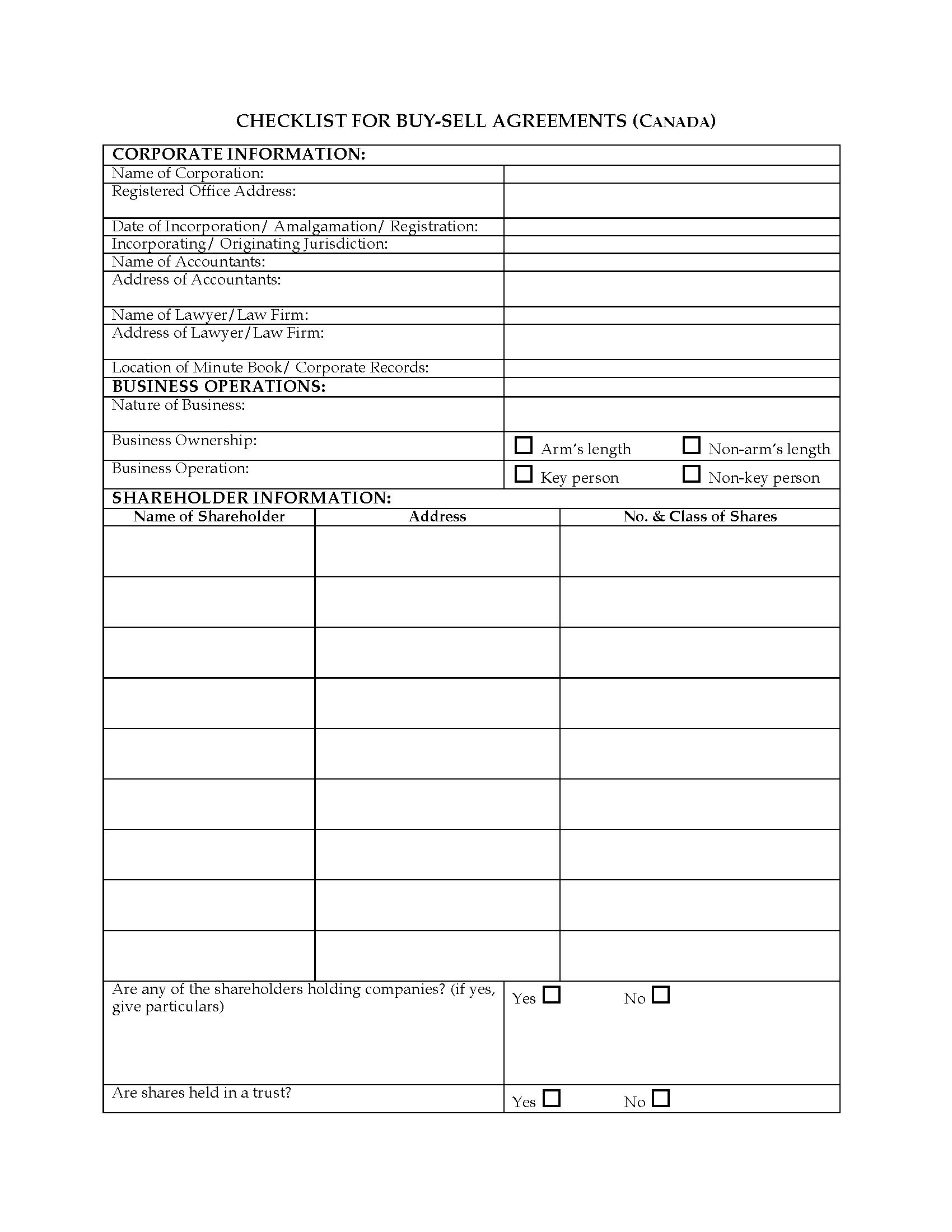

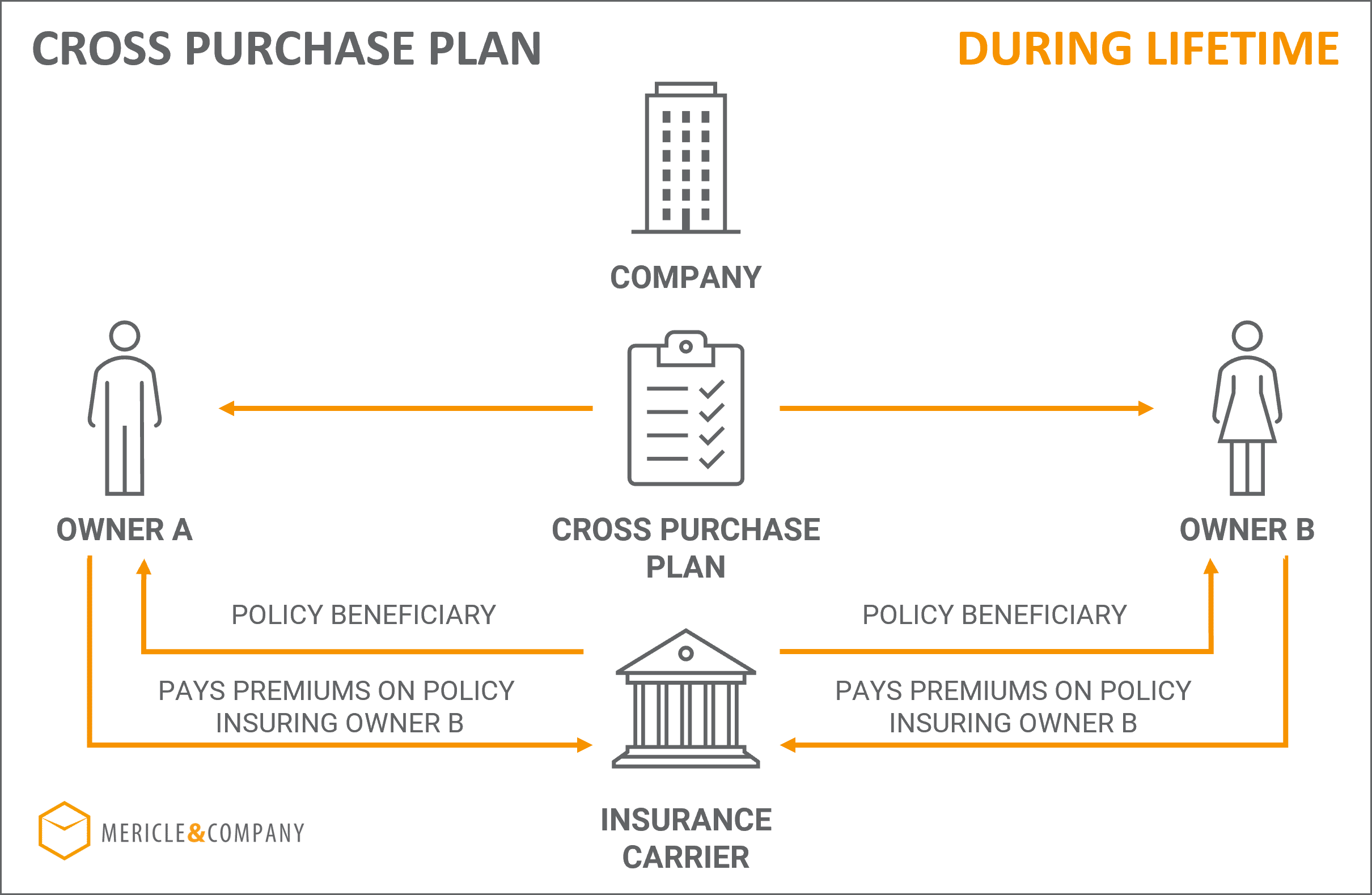

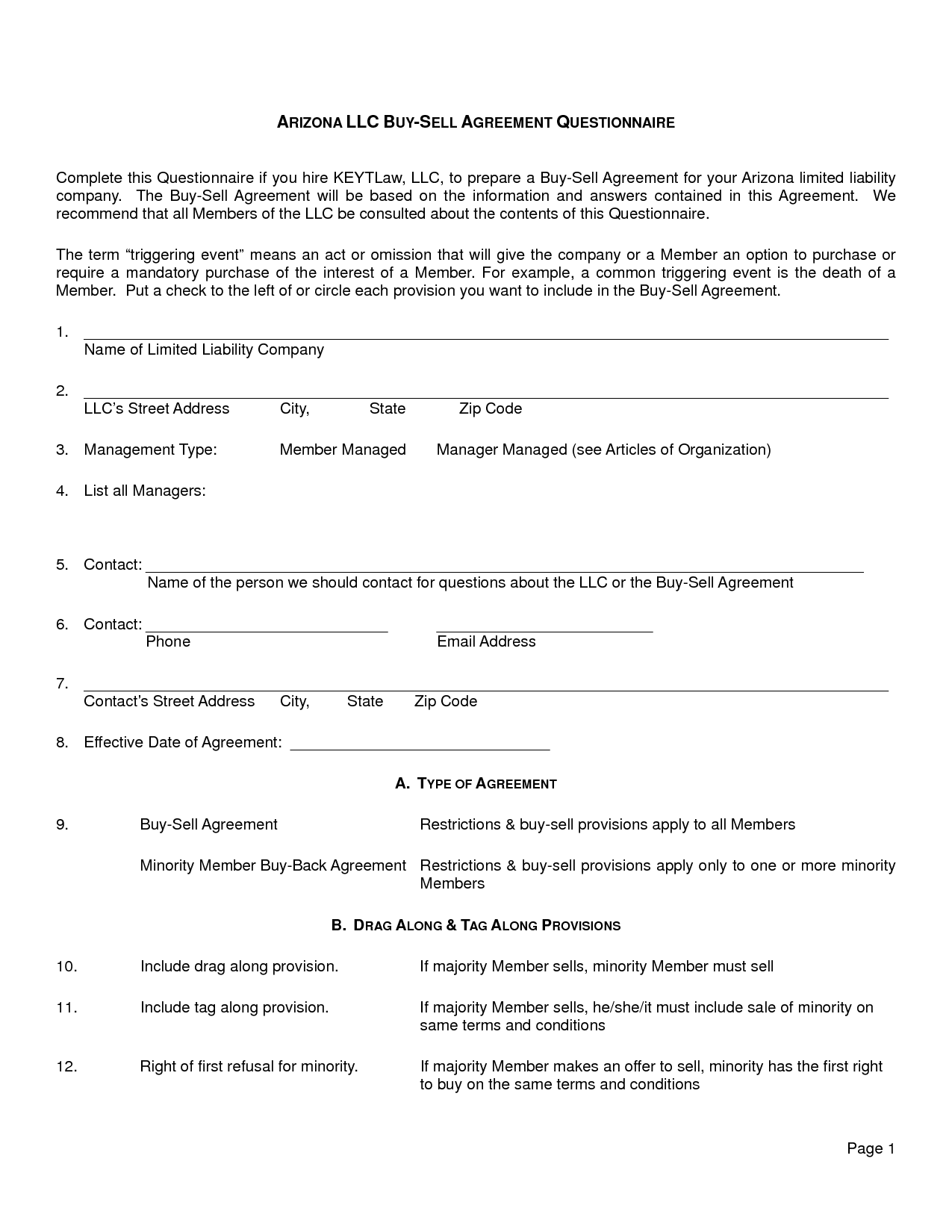

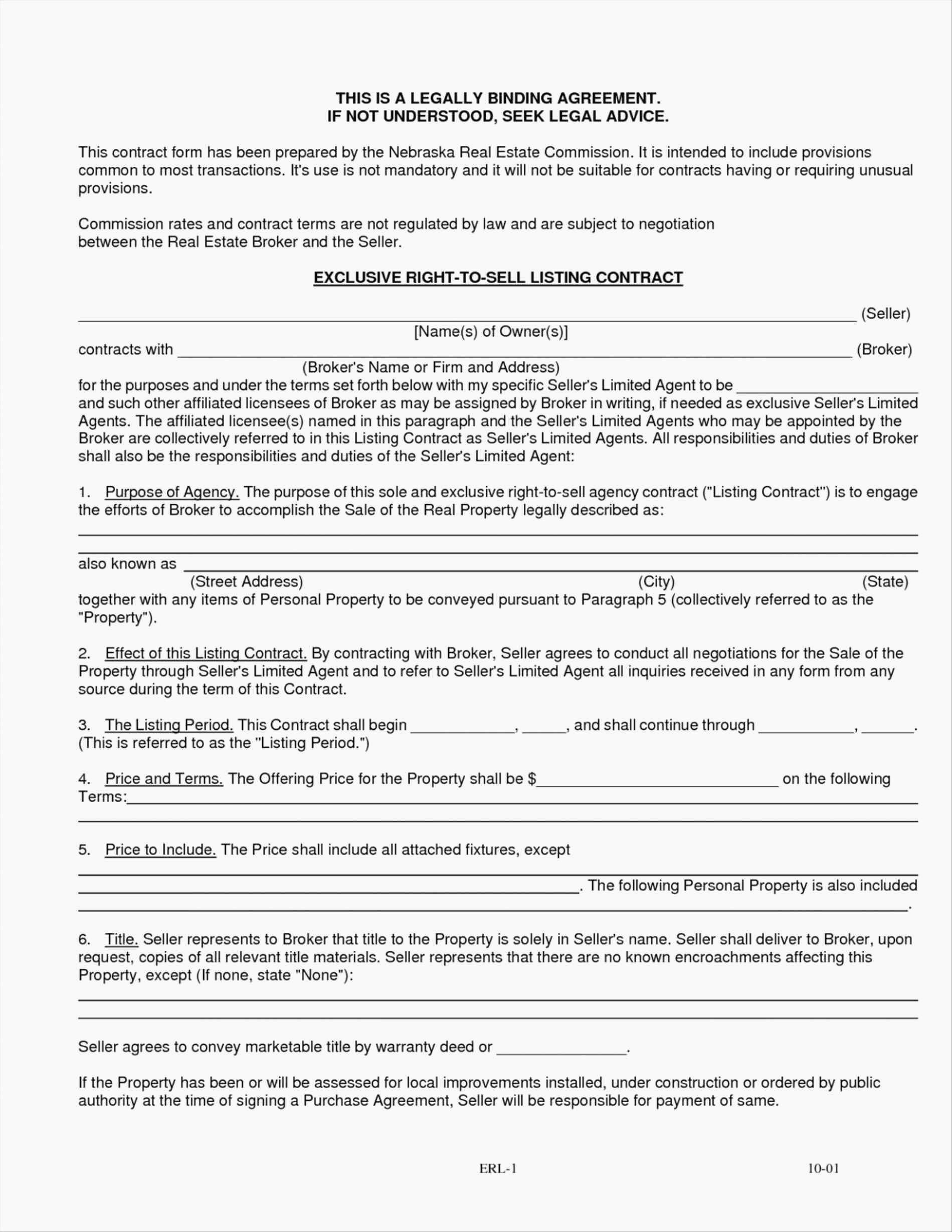

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Sample-PDF-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Word-Document.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Template-of-Buy-Sell-Agreement-Free.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Blank-Form-of-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Sample-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Word-Formatted-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Word-Document-of-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Template-Free.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Template-Example.jpg)