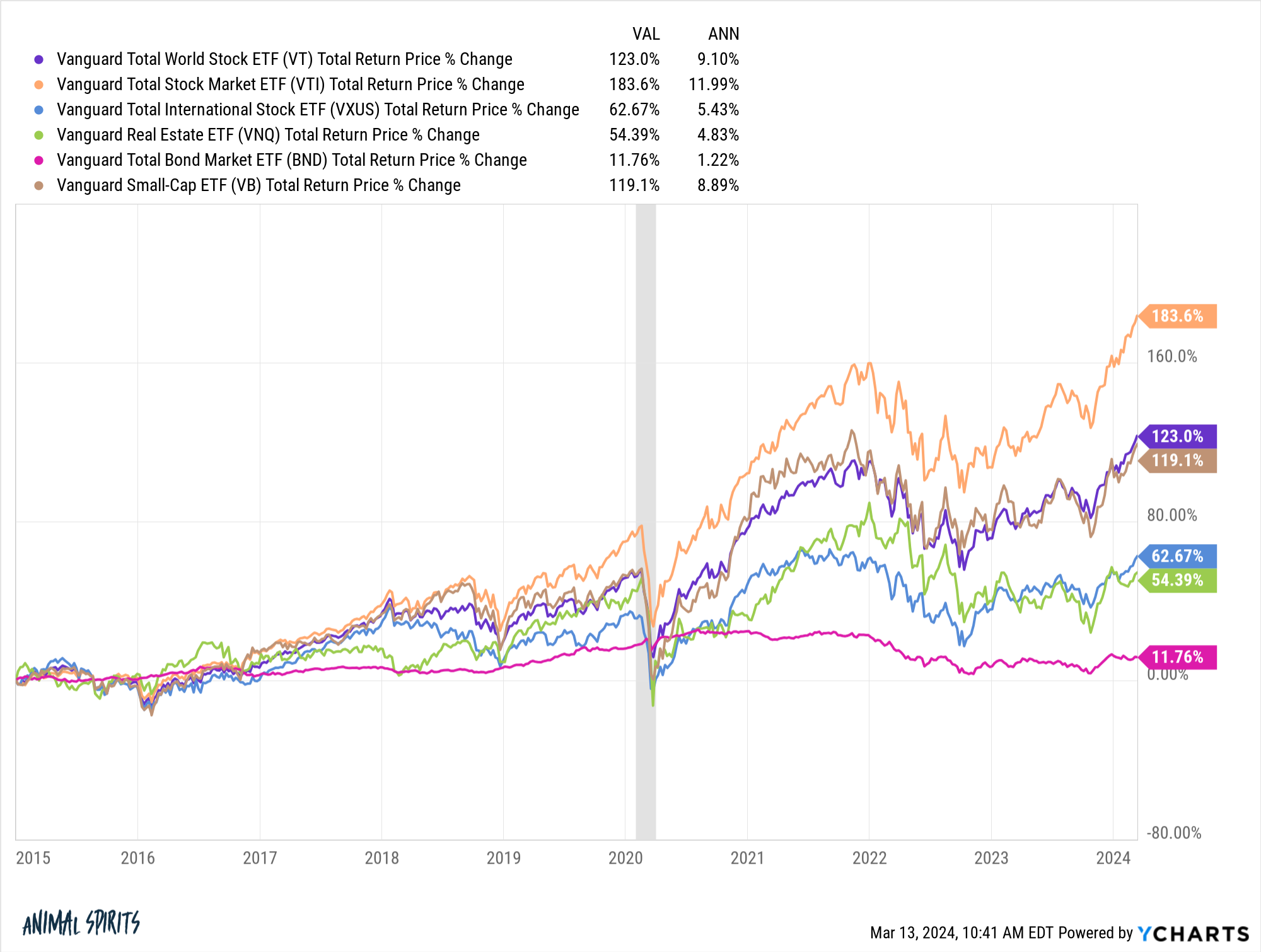

Webthe most ideal thing is to rebalance vti/vxus. If you have 100m nw then it saves you a lot. If you’re Point is there is no wrong. Weboct 4, 2024 · compare and contrast key facts about vanguard total stock market etf (vti) and vanguard total international stock etf (vxus). Vti and vxus are both. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that. Webfrom a financial standpoint, vti + vxus > vt only if you allocate / rebalance properly. While you can do better due to the slightly lower fees, human emotion / error in the. Webassuming a market weight equity portfolio, if you hold vtsax+vxus instead of vt then 40% of your equity would be vxus, so the value of the ftc would be 0. 09% (0. 23 * 40%) or greater than the entire expense ratio. Webcompare vti and vxus etfs on current and historical performance, aum, flows, holdings, costs, esg ratings, and many other metrics.

Recent Post

- Jailbirds Greenwood Sc Inmate Search

- Return Policy At Dollar General

- F 150 Lightning Forum

- Spanking Witnessed

- Adisc Stories

- Buffalo Am Radio Stations

- Ao3 The Outsiders

- Variable Whole Life Insurance Can Be Described As Quizlet

- Walmart Security Jobs Pay

- Should I Worry About My Lip Twitching

- Lower Lip Itching Spiritual Meaning

- Scott Rothwell Funeral Home Obituaries

- Cbs Baseball Fantasy

- Caresource Otc Card

- Dogtopia Job

Trending Keywords

Recent Search

- Obamas Friend Michael

- Quizlet Political Parties

- Zach Bryan Concert Setlist 2024

- Steve Harvey Youtube

- Mugshots Catering

- Prosolutions Training Health And Safety

- Sirius Xm App

- Jodi Arias Interrogation

- Cookie Clicker Combos

- Myrtle Beach Arrests 90 Day

- Hr Block London Ky

- Homeschooling Picker Kayla And Part Time Picker

- Stock Male Pictures

- Ann Wedgeworth Cause Of Death

- Jobs That Make 20 An Hour

_14.jpg)